News Article

QIMA 2023 Q4 Barometer

Q4 2023 Barometer: Is China Sourcing Back in the Spotlight as Consumer Demand Slows Down in the West?

In a context of cooling consumer demand, global brands and retailers appear to be pushing China sourcing higher on their agenda again. Meanwhile, many of China’s competitors struggle with the recent influx of new business, and some of them are better equipped than others to handle the rapid growth. This barometer report, informed by QIMA’s data on product inspections and factory audits, offers an insight into the shifting state of the global sourcing landscape as 2023 draws to a close.

China back in the textiles game as Western buyers shift order volumes back in the run-up to the holidays

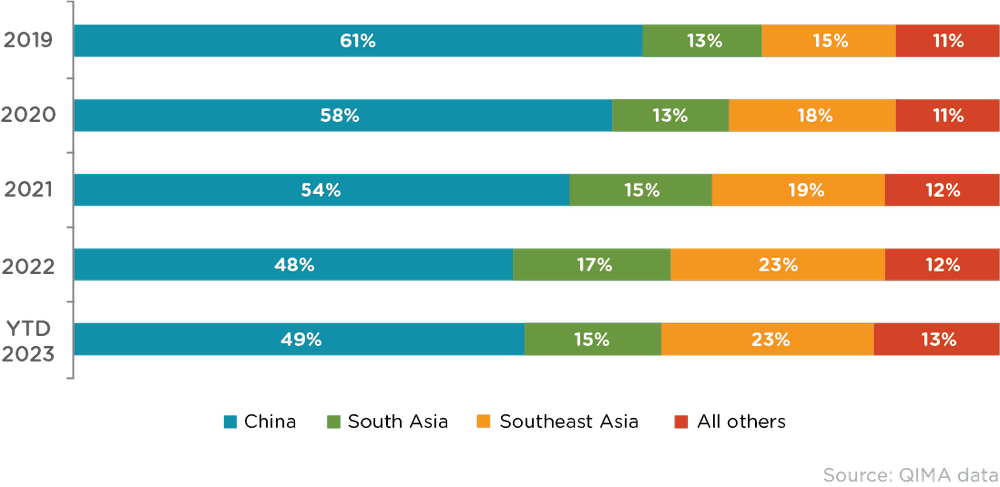

During the past few years, in the wake of tariffs wars, Covid lockdowns and geopolitical uncertainty, Western buyers have shifted significant sourcing volumes from China to other supplier markets, including China’s competitors in South-east and South Asia, as well as nearshoring regions. However, recent QIMA data suggests that interest in China sourcing may be picking up again among US- and EU-based buyers: in the first nine months of 2023, the relative share of China in their supplier portfolios has increased for the first time since 2019.

It appears that as consumer spending in the West is slowing down due to fears of economic downturn, brands and retailers may be prioritizing China as a supplier again, to leverage the benefits of its well-established manufacturing infrastructure.

This trend is particularly apparent in the Textile and Apparel sector. QIMA data for the first nine months of 2023 shows demand for textile inspections and audits in China growing by +14% YoY globally and by +17% YoY among Western buyers.

By comparison, inspection and audit demand in two of South Asia’s textile powerhouses, Bangladesh and India, contracted year-on-year in January to September 2023, while remaining above 2021 levels.

US and EU buyers’ top sourcing markets by share

With cooling demand for South Asia textile sourcing, Bangladesh needs to diversify its exports to stay competitive

Bangladesh exports have been struggling this year, including its flagship textile and apparel sector, where QIMA data shows a -10% YoY dip in demand for inspections and audits during the first nine months of 2023. US-based buyers in particular appear to be scaling back textile and clothing sourcing from Bangladesh.

While trade with EU-based brands has been livelier by comparison, recently published research points out that Bangladesh should diversify its supplier offering to protect its exports from future shocks. The country’s apparel industry, which is currently heavily cotton-oriented, can benefit from branching out into manmade textiles (For comparison, Bangladesh holds 34.7% share in the EU’s cotton imports, whereas its share for non-cotton garments is only 12%). Outside of the RMG sector, there is a lot of export potential in other consumer goods, such as footwear, leather, and home textiles, among others. Electrical and electronic goods also offer valuable export opportunities, but to compete on the global stage in this field, Bangladesh needs to strengthen local institutions responsible for internationally recognized certifications. Additionally, ensuring that manufacturers have access the necessary testing facilities is vital for success.

Mexico takes the crown as the US’s largest trading partner, driving home the importance of nearshoring

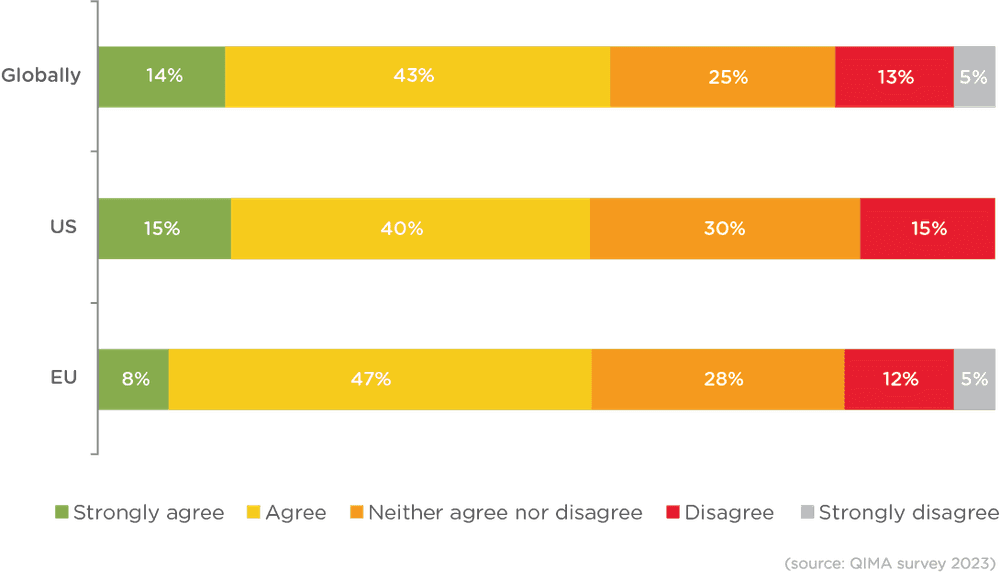

Earlier this year, QIMA survey asked businesses with international supply chains whether they plan to use nearshoring as a part of their sourcing strategy: and over half of US- and EU-based businesses confirmed that they were interested in working with suppliers close to home. Now, QIMA data from the respective regions confirms that these plans are going full steam ahead.

Mexico, which has surpassed China as the US’s largest trading partner in 2023, saw demand for inspections and audit grow +17% YoY in Q3. As Mexico offers many benefits to US-based buyers, such as geographic proximity, zero tariffs, low labor costs and a relatively mature manufacturing base, the country has been attracting new business at an impressive pace (by some estimates, Mexico’s industrial space has grown 30% since 2019). However, like in any other region, sourcing from Mexico also presents some challenges, including infrastructure, power availability, and security.

Meanwhile, EU-based brands are still doing a lot of business with suppliers around the Mediterranean: QIMA data shows double-digit expansion in demand for inspections and audits in Q3 2023. This year-on-year growth was observed in well-established supplier markets such as Turkey, as well as newer manufacturing partners that include Jordan, Tunisia and Egypt.

Fig. N1: “Is nearshoring included as part of your short and medium term supply chain strategy?”

Product quality is a major challenge for diversifying supply chains

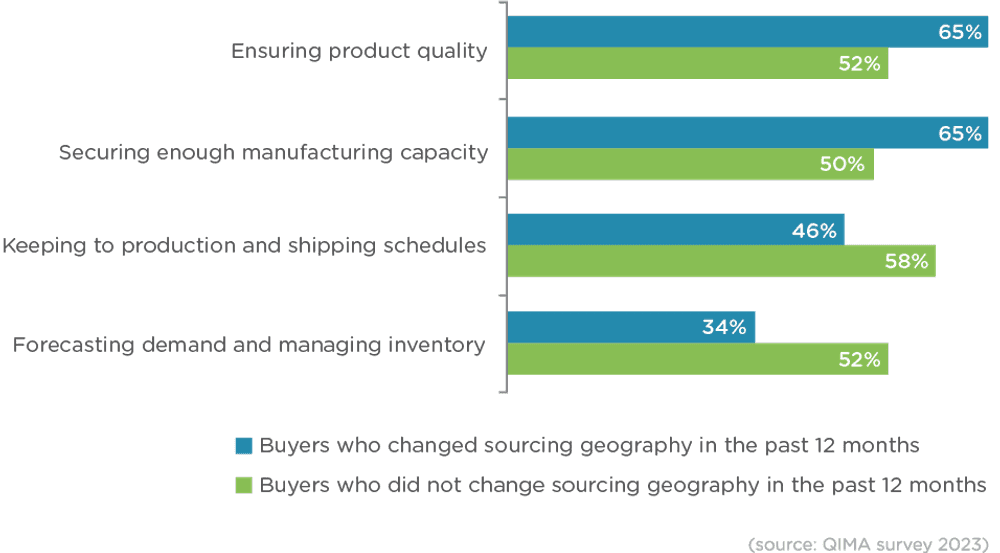

Previously, the QIMA barometer reported that businesses which have recently diversified their supplier geography tend to struggle with product quality more than those that have not. QIMA’s latest aggregated data from product inspection now offers additional context on this finding.

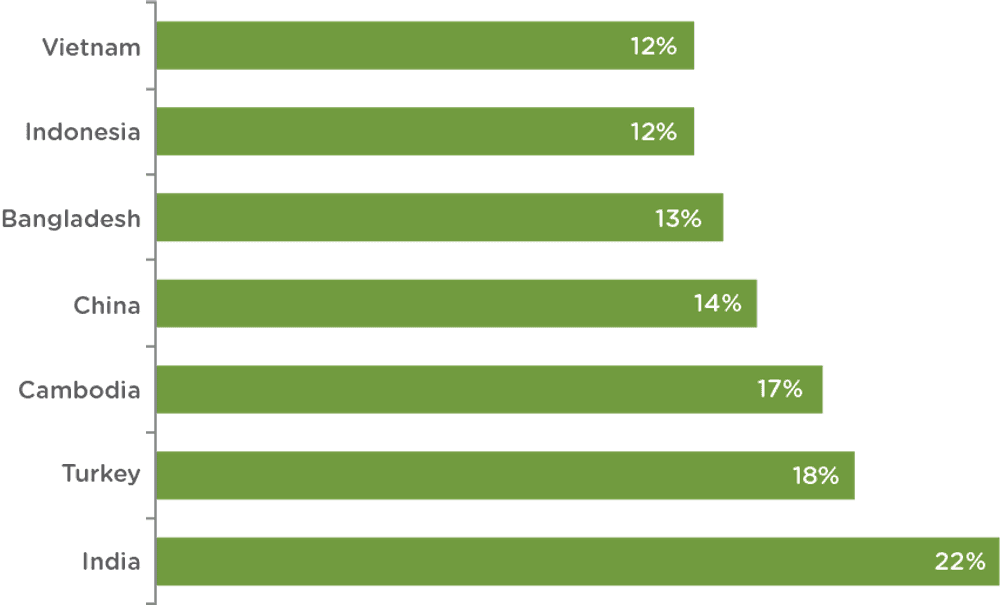

Overall, less mature supplier markets tend to have higher rates of product defects, as shown by the percentage of products found to be outside of Acceptable Quality Limits, or AQL (an indicator widely used to determine whether a product order meets the client’s specifications). However, QIMA data also indicates that large influxes of new business can impair product quality even in well-established sourcing hubs. For example, inspection data for the first nine months of 2023 shows Beyond AQL rates in Vietnam spiking 44% year-on-year, suggesting deterioration in product quality in a supplier market that has historically performed well. The same is true for nearshoring markets: Mexico, which is still receiving large volumes of new business from the US, saw the rates of product defects more than double in the first nine months of 2023 compared to the same period of the previous year.

Fig. Q1. Top sourcing challenges named by QIMA survey respondents globally

Fig. Q2: Percentage of products found outside Acceptable Quality Limits, January – September of 2023 (lower value indicates better product quality)

Press Contact

Email: press@qima.com