News Article

QIMA 2025 Q4 Barometer: Despite the US’s Continued Tariff Posturing, the World is More Interested in Trade than Trade Wars

Download PDF version or listen to our Supply Chain Soundbites podcast on YouTube or Spotify.

Six months after “Liberation Day,” the United States’ string of trade agreements has made headlines – but it may be the alliances taking shape between other major economies that carry the greatest long-term weight for global commerce. With the holiday season approaching, QIMA’s Q4 2025 barometer examines how these emerging partnerships could help steady procurement in a year marked by turbulence and uncertainty.

“Friend-Shoring” Gets Tougher for US Supply Chains as Trade Relations Strain

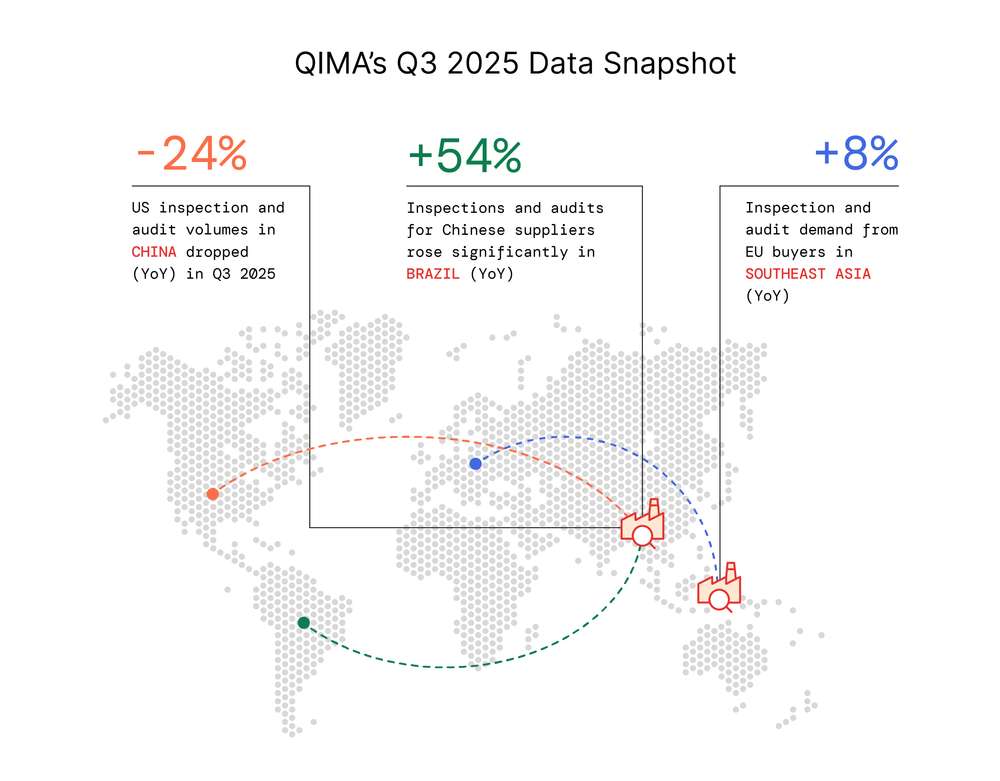

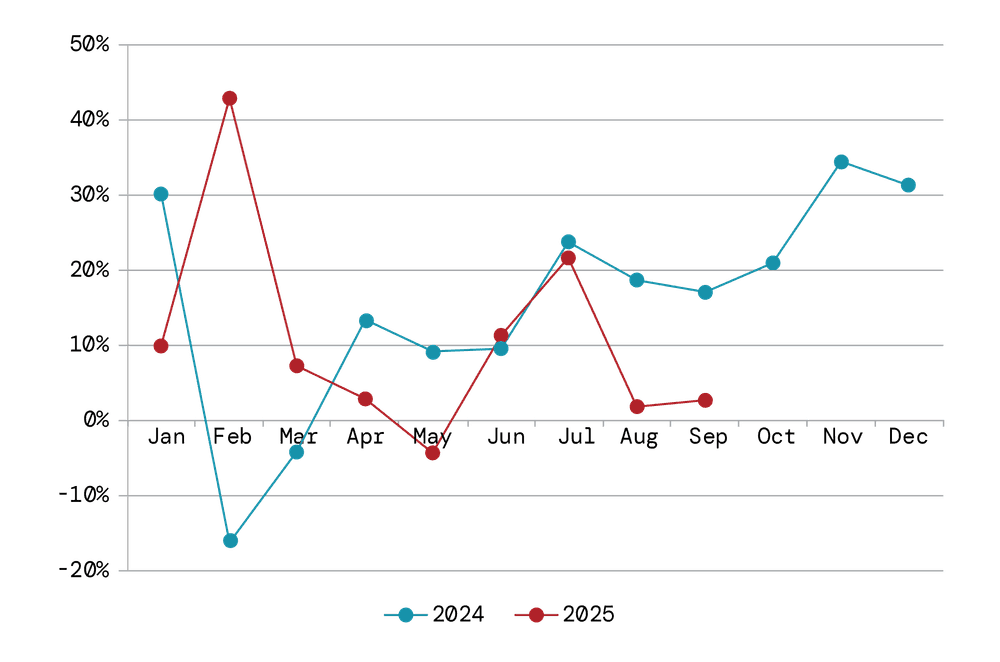

Nearly six months after “Liberation Day,” the effects of the US administration’s trade policies on supply chains are becoming clearer. QIMA’s aggregated sourcing data shows a slowdown in US overseas procurement from August onward: after peaking in July (+22% YoY), inspection and audit activity by US buyers remained subdued in both August and September, a contrast to last year's trend.

Much of this decline stems from the ongoing shift away from China, where US inspection and audit volumes dropped -24% YoY in Q3 2025. Throughout the quarter, other Asian sourcing hubs worked to fill the gap. Southeast Asia and South Asia saw inspection activity rise +39% and +26% YoY, respectively, with double-digit growth in demand recorded in Vietnam, Cambodia, Indonesia, Bangladesh, and Sri Lanka. Still, these supplier partnerships are also coming under threat: escalating trade tensions with India in late August are already showing in US sourcing patterns, while the US’s new “transshipment tariffs” threaten to disrupt business with Southeast Asia’s manufacturing hubs – especially Vietnam – in the months ahead.

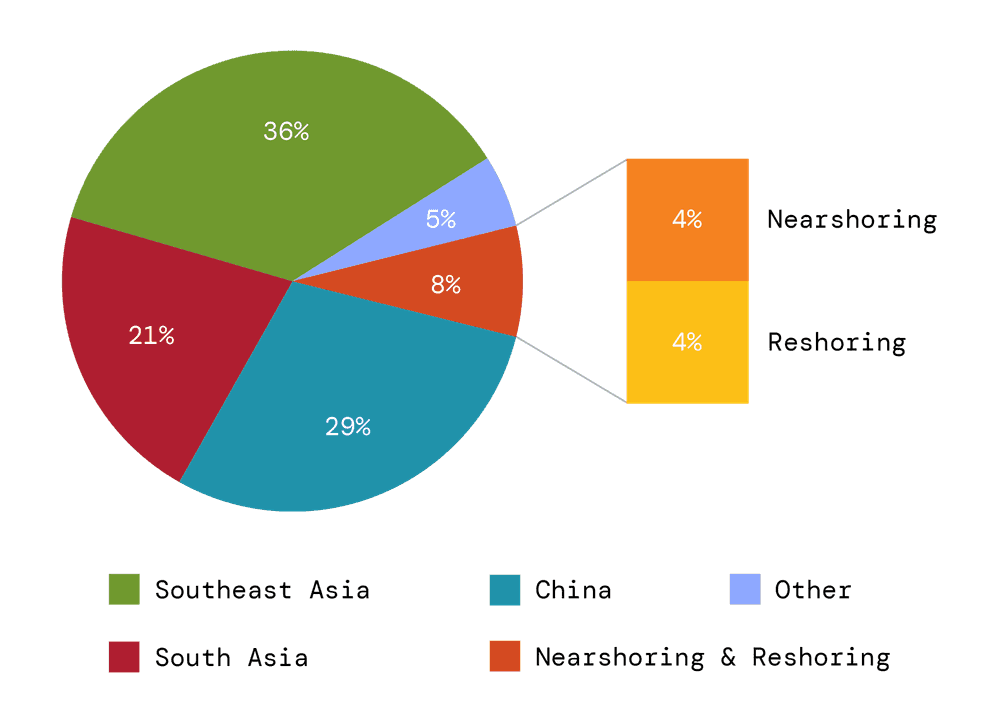

Meanwhile, US nearshoring and reshoring are advancing slowly, with only 8% of total procurement in Q3 coming from the home region. As alternatives to overseas sourcing, these options remain very limited in scale: especially considering that brands often turn to domestic suppliers to supplement, not substitute overseas procurement.

With key trade relationships under strain and ties with the EU further cooled by the recent deal, US supply chains are entering the holiday season with fewer options and rising uncertainty.

Fig. 1. Inspection and audit demand globally from US-based buyers, YoY monthly growth trend

Source: QIMA data on inspections and audits

Fig. 2. Relative share of US sourcing regions, Q3 2025

Source: QIMA data on inspections and audits

With US Orders Down, China Leans on New Partners While Latin & South America Drive Asian Output

As the trade war with the US drives down American demand for made-in-China, diversified trade partnerships remain a key strategy for Chinese exporters, with emerging markets maintaining great importance. Latin and South America, with their expanding consumer base and steady appetite for Asia-made goods, continue to be major players in this shifting trade landscape.

Building on trends highlighted in earlier QIMA barometers, businesses in Latin and South America kept up strong sourcing activity from China and its neighbors throughout Q3 ’25. Inspections and audits for Chinese suppliers rose significantly in Brazil (+54% YoY), Argentina (+16% YoY) and Uruguay (+69% YoY), while demand from Venezuela and El Salvador more than doubled year-on-year. The fastest-growing categories were Textile & Apparel and Electricals & Electronics, with Homewares, Construction, and Mechanical products also seeing healthy growth in several buyer markets.

EU Buyers Keep Overseas Sourcing Steady, Strengthen Mediterranean Partnerships

While EU leaders are hard at work to strike a delicate balance between old and new trade alliances, European brands and retailers have refrained from major supply chain moves this past quarter, QIMA’s data suggests.

For overseas sourcing, EU-based buyers have largely stayed on the course set in the previous quarter, continuing to rely on Southeast Asian suppliers in the run-up to the holiday season. Demand for inspections and audits rose +8% YoY across the region, led by Vietnam (+21% YoY), Thailand (+18% YoY) and Cambodia (+10% YoY) .

Closer to home, nearshoring partnerships around the Mediterranean saw solid gains in Q3 ‘25, with inspection activity up +15% YoY in Morocco, +19% YoY in Tunisia, and +24% YoY in Egypt, reflecting its growing role as Turkey’s regional rival, bolstered by major foreign investment in its textile industry.